Brother, imagine you are a student, you want to take a loan for college or maybe a personal loan for bike. Now the bank person says Do you want fixed rate or variable? and you start thinking what language is he speaking? this article will explain to you in very simple language what these two rates are and which one will suit you.

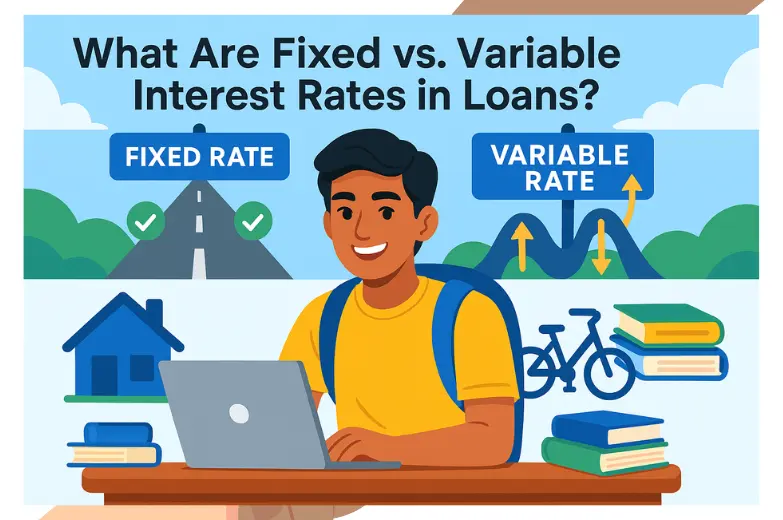

Fixed rate means absolutely stable no tension of changing payments, Variable rate is a little risky sometimes less and sometimes more We did some research about it. talked to lenders and saw real examples so that you get a clear picture.

In this article we will cover the basic difference of these rates pros-cons and also which loan you should take. Plus there is also an FAQ at the end so that you get answers to all your questions. Let’s get started

Understanding Fixed Interest Rates

Friend, fixed interest rate means a rate that never changes whether the loan is for 5 years or 30 years. For example if you get a home loan of Rs. 5 lakh at 6% fixed rate then you have to pay the same EMI every month no surprises.

The simple formula is Interest = Principal × Rate × Time. This helps you in budgeting because you know the exact EMI. Fixed rates are mostly available in mortgages personal loans or student loans.

If it is stable then tension is less but the starting rate can be a little high. Do you think this will suit you.

Understanding Variable Interest Rates

Now variable rate is a little different brother. This rate keeps going up and down according to the market like stock market.

For example a student loan starts at 5%, but if market rates go up then the EMI can also increase. Nowadays variable rates are around 4-7%, but it depends on the economy.

There is risk in this, but if rates go down then you can also save, Mostly this option is available in mortgages and personal loans. It feels a little adventurous but is risky too. What do you think is it worth trying?

Fixed VS Variable Interest Rates Key Differences

Let’s do a quick comparison. A fixed rate loan is stable same payment every month no tension. But the rate is a little higher in the beginning. Variable rate seems cheaper in the beginning but can change with the market, so the EMI can jump anytime.

For example, in a personal loan the fixed rate can be 8% while variable starts at 6% but can go up to 10% later. Fixed is for safe players, variable is for a little risk-takers. What do you want a solid one or a little gambling vibe Depends on your budget and mood to take risks.

Which Is Better Fixed Or Variable-Rate Loan?

The answer to this question depends on you. If you are a student, on a fixed budget then fixed rate is best like fixed-rate mortgage or student loan. EMI will remain same so planning is easy. But if you think market rates will be low then you can try variable rate like short-term personal loan.

For example, fixed rate is safe for student loan as it is long-term. Variable rate is good for short-term loans, but risky. Think what is your financial goal? Do you need long term planning or do you want to take risk for little savings Talk to lenders compare and decide.

Reed: 10 Tips To Graduate College Debt-Free

Pros And Cons Of Fixed And Variable Rate

Fixed Rates: The advantage is that the EMI is fixed no headache in budgeting. Home buyers like this. Disadvantage The starting rate is a little high and sometimes there is a penalty on early repayment.

Variable Rates: Initially the rate is low so money can be saved if the market is stable. But the biggest disadvantage is that if the rates increase then the EMI also increases, which can spoil the budget. For example variable rate seems cheap in personal loan but if it increases suddenly then it creates tension. What do you want safe play or a little risk for saving? Decide after thinking about your scene.

What Can I Change Or Do Quickly?

If you don’t like fixed rate you can switch to variable by refinancing but check the lender’s rules. Do you want to repay fixed-rate loan quickly? Yes, you can, but some banks charge a penalty so read the terms.

It’s the same scene with variable rate but there is more flexibility. You can convert fixed to variable or variable to fixed through refinancing, just take care of the paperwork and fees. What is your plan are you ready to get it cleared quickly or are you okay?

What Are Mortgage Rates These Days?

Aajkal fixed mortgage rates 5-7% ke aaspaas hain, jabki variable rates 4-6% se start hote hain, par badh bhi sakte hain. Yeh rates bank aur economy pe depend karte hain. For example, agar RBI rates badhati hai, toh variable rates upar ja sakte hain. Exact rates ke liye apne bank ya online tools check kar. Thodi research karna padega, par worth it hai taaki tujhe best deal mile. Kya soch raha hai, abhi loan lene ka plan hai?

Which Loan Should You Take?

it is your personal call. If you are afraid of risk and are on a fixed budget then go for fixed rate. But if you can take a little risk and see a chance of market rates being low then try variable. Talk to lenders compare two-teen offers. Financial advisors can also help. Keep your goal clear loan for house bike or studies? Decide after thinking everything through don’t take tension.

FAQ:

Which Loan Has A Variable Interest Rate?

For variable rate loans, such as some mortgages, personal loans, or student loans, the rate changes with the market.

Is Fixed Rate Better Or Variable?

It depends, friend. Fixed rate is safe, EMI remains constant. Variable is cheaper initially, but can increase. Decide according to your budget.

What Are The Disadvantages Of A Fixed-Rate Mortgage?

The rate is a little high in the beginning, and sometimes there is a penalty for paying early. Have any other questions? Ask in the comments!

Conclusion

Brother, fixed rates are safe there is a chance of saving in variable rates but there is risk too. Decide after looking at your budget loan type and market trends. Talk to banks compare rates and get the best deal. If there is any confusion comment we will clear it. Now go plan your loan.

At LoanJus.com we provide students with the simplest and most accurate information about education loans, scholarships, and career planning. Our aim is that every student can achieve his dream education and career without any confusion always with you, Plz Follow X.com